As the summer season reaches its peak over the next few weeks it seems that the pandemic is now a thing of the past and revenge spending appears as strong as it was in the early stages of the travel recovery.

Global airline capacity will reach 512 million in July compared to the 524 million of July 2019, a mere 12 million gap or 2.3% adrift of pre-pandemic levels. However, that assumes no real market growth would have occurred between 2019 and now - cautiously that could have been in the region of 50 million more seats, but let’s ignore that small point. So, a gap of just 12 million against a backdrop of a changing market, more low-cost capacity share, modal shifts and some relatively small but fast emergent markets in Central Asia leaves me asking what happened to those 12 million seats, where are the gaps and of course are they ever going to be filled?

Finding The Gaps

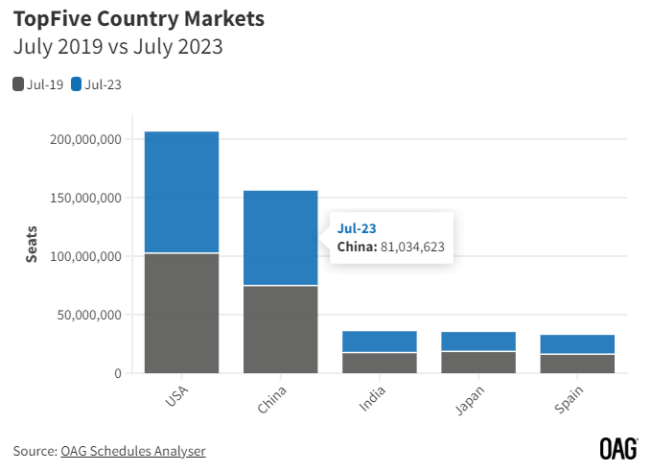

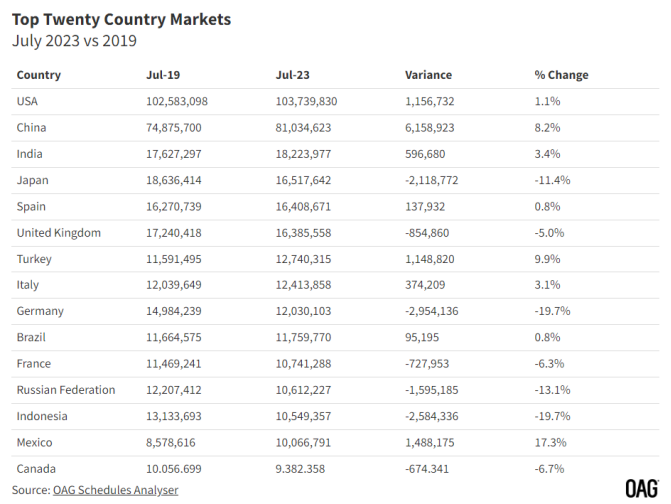

The first place to look is the major country markets, the top twenty accounted for 75% of global capacity in July 2019 but now account for nearly 86% which would perhaps play to the big always get bigger theory, especially in a recovering market. But it’s not quite that simple. At the very top of the table there is no change with the USA still the largest market in the world followed by China in second place but at some distance back - and remember that we were expecting China to claim top spot about now. Below that India has taken third spot from Japan who are now in fourth, while Spain has snuck above the UK to claim fifth, so some churn occurring.

Throughout the pandemic we regularly noted that every region and country was having their own event and even today across the major markets (as the table below shows) there are major variances in recovery. In China for instance the mix of capacity changed dramatically during the pandemic with - at times - virtually no international capacity, this month 5% of Chinese capacity will be to international destinations, but at 4.4 million seats it’s just half of pre-pandemic levels although ten times larger than last year; it’s amazing how you can “spin” data!

For both Japan (-11%) and South Korea (-23%) any further recovery remains dependent on the rebuilding of connectivity to China and as noted above that has a very long way to go, so we shouldn’t expect any significant change in their respective recoveries for some time. A secondary factor for both countries remains the closure of Russian airspace to some airlines which adds a considerable amount of time to their journeys and of course cost. India’s rise to third reflects the rapid growth in capacity both domestically and through the expansion of Air India services to the UK, North America, and Australia as they seek to build a credible hub operation in Delhi.

The collapse of airline capacity from Germany (-20%) is based upon a series of factors. Lufthansa’s slower return to operations than many other carriers has put them behind the game and domestic capacity in the country is now only half of that reported in July 2019 as modal switching to train is encouraged where possible. Overlay those structural factors with the continual threat of ATC disruption in the country this summer and Germany is proving to be a harder market to operate in than had previously been the case.

Looking at capacity by each country provides a degree of insight as to how the summer is shaping up but drilling down a bit deeper provides a clearer picture of where those actual capacity gaps really are. And one market that stands out as still having a long way to recover is China.

Read original article