Ancillaries are the additional services and products airlines offer beyond the base airfare, such as premium seat selection, priority boarding, additional baggage, and even hotel bookings and car rentals. Over the past decade, ancillaries have transformed from mere add-ons to becoming a cornerstone of airlines' financial health. They represent an invaluable revenue stream in an industry characterized by tight margins and intense competition.

In light of more airlines selling their flights through their direct (airline.com) channels and NDC's potential to present personalized offerings, the landscape of ancillaries stands at the precipice of exponential growth, instigating a profound paradigm shift in customer service and experience within the airline industry. To navigate this terrain, airlines are increasingly inclined towards holistic decision-making, considering total passenger revenue for each flight as a comprehensive metric.

A primary strategy for achieving this augmentation in total revenue - beyond merely raising fares - is the pursuit of enhanced ancillary revenue. This approach provides an exciting avenue for diversification and personalized service, further contributing to the evolution of the industry.

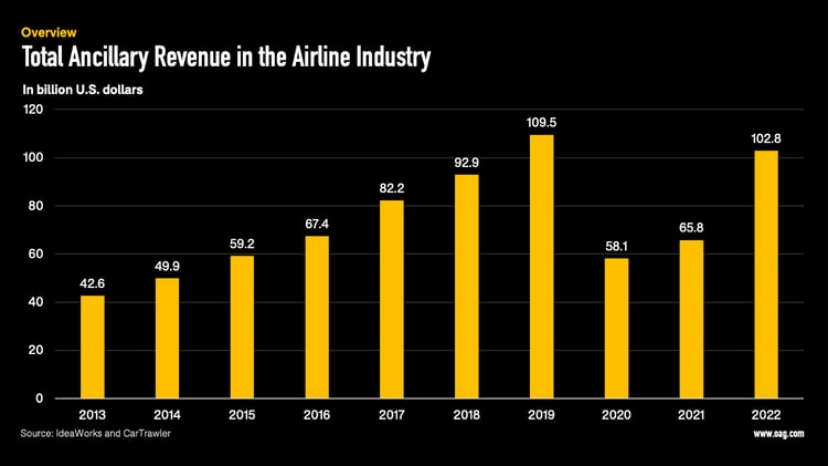

In order to truly understand the transformational impact of ancillaries in the airline industry, it is important to evaluate their quantitative significance.

Ancillary revenues are not just a supplemental income source for airlines but have evolved into a critical driver of financial robustness.

Comprehensive research conducted by IdeaWorks and CarTrawler illustrates this shift.

Over the span of less than a decade, global ancillary revenues dramatically rose from $42.6 billion USD in 2013 to over $102 billion USD in 2022. Even more impressive, 2022's figures almost matched 2019’s record of $109.5 billion USD, despite the disruptions caused by the global pandemic.

Following this chart, it becomes evident that the impressive growth trajectory has elevated ancillaries to a crucial pillar supporting airlines' financial stability.

This dependency on a strong ancillary segment becomes clear when we delve into the proportion of total airline revenue that is derived from ancillaries. In 2022, a historic high was reached, with ancillary revenues accounting for a staggering 15% of total airline revenue.

Such a significant share underscores the strategic importance of ancillary revenues and highlights the need for airlines to effectively manage this ever-expanding category. This is evidenced by the likes of Qatar Airways, Lufthansa Group, and Air France-KLM, which have achieved ancillary revenue contributions of about 5.2%, 8.5%, and 8.7% respectively as calculated by CarTrawler. These figures further underline the role of technological advancements and new distribution models, like NDC, in unlocking the full potential of ancillary revenue streams.

Read original article