When you have the whole world to look at - and masses of data at your fingertips on the OAG data platform - it’s easy to gravitate toward the larger markets of North America, Europe, and Asia where there are plenty of stories to be written every week! Stepping back from the numbers, we have examined some of the smaller IATA defined regions of the world, where we have noticed some interesting changes taking place in both the structure of the market and available capacity - with Central Asia looking amongst the most interesting.

The first thing to say is that, of course, the smaller regional markets of the world are just that - small. However, in percentage terms, their growth is both important to them and, perhaps, the future expansion of global capacity from the world’s larger regions (as we will highlight later).

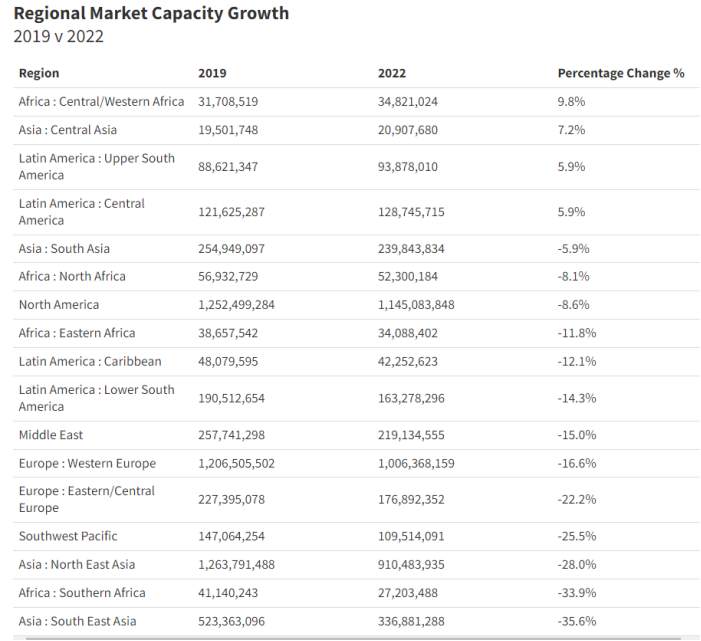

The table below shows airline capacity by all regions of the world for 2019 versus 2022, ranked by percentage growth. Central Asia ranks as the second fastest growing market, however, we should also point out that it ranks as the smallest region in the world from a capacity perspective – although in distance terms it’s vast, covering four million Km2 which is twice as large as Western Europe.

Another factor impacting the respective size of Central Asia is that there are only four major country markets covered, whereas in many other regions, there are multiple country markets covered; Western Europe, for instance, covers twenty-seven countries ranging from the United Kingdom to the Faroe Islands.

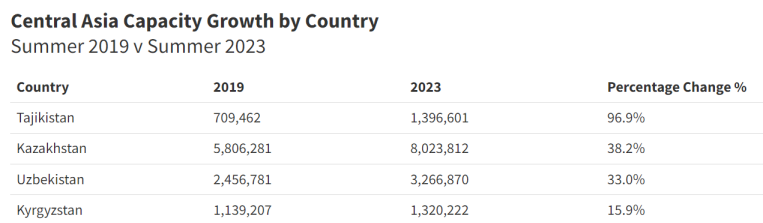

The rate of capacity growth is impressive, evident by comparing scheduled airline capacity for summer 2019 against this year (summer 2023) with Tajikistan seeing a near doubling (+97%) of capacity - although it still ranks third of the four country markets. Breaking through the eight million seat mark this summer season is Kazakhstan; an impressive 38% growth against the 2019 level.