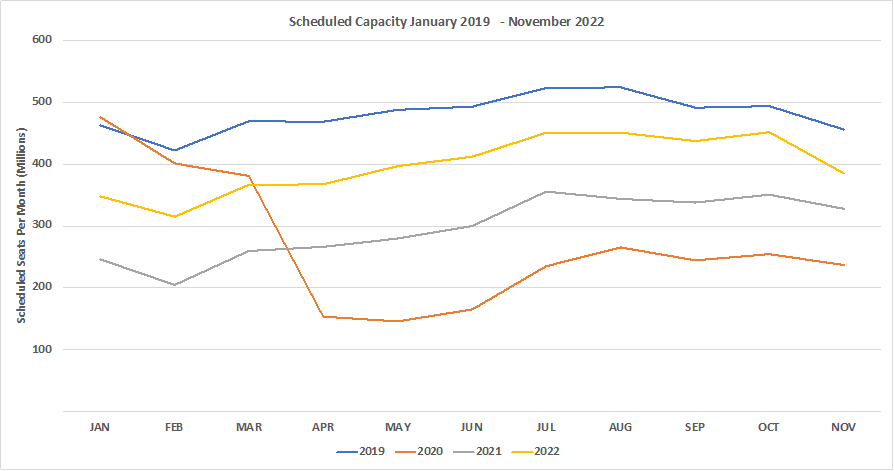

Although global airline capacity remains above the 100 million seats a week mark it is likely that this will be the last week that we manage to break that barrier for the rest of the year.

Week-on-week some 4 million seats were dropped from this week’s operating programmes. Next week’s data is already hovering just above the 100 million seat mark, and allowing for the current rate of capacity drop each week, we will be back in the high nineties in seven days’ time. In every sense summer is coming to an end, schools are returning, everyone is returning to work, the days are shortening in the Northern Hemisphere and corporate demand is returning; well, most of those things are happening!

A Mixed Travel Recovery Continues Across the World

As with every other week in recent times, there are mixed messages of a travel recovery in some places and further airline capacity cuts elsewhere.

Japan has finally eased their travel restrictions on arriving visitors from early September, just as the holiday season comes to an end; a perfectly arrived event! Meanwhile the United States has banned several Chinese airlines from operating in what has been described as a “tit for tat” piece of action to the current restrictions imposed in China on airlines who innocently carry a covid infected passenger. In Europe, capacity caps look likely to remain in place at some major airports throughout the winter , this may increase average load factors on short-haul services if demand remains strong - something which is questionable in a challenging headwind of economic factors. There is never a dull moment in the aviation sector for sure.

Airlines Adjust Capacity for the Coming Months

Although there remain some 1.34 billion seats scheduled through to the end of October, in the last seven days 18 million seats have been removed from sale (1.4% of those on offer last week). Increasingly airlines are looking at the strength of demand for the coming months and where possible are looking to consolidate. The major US airlines have in the last few months removed between 8-10% of their planned capacity for the last quarter of 2022, and other carriers in various markets are following. Last week, British Airways had 5.6 million seats scheduled from their London Heathrow base for the last quarter of the year, they have now cut that back to 5.1 million as they respond to extended airport capacity caps.

Source: OAG

The relaxation of travel requirements for entry to Japan are not reflected in this week’s flight data, and in all likelihood until China once again allows for unrestricted international travel the impact on airline capacity will be quite small. However, destinations such as Thailand and Vietnam can expect to see more golfers hacking around their courses, whilst the beaches of Okinawa will finally see more South Korean tourists.

Global Airline Capacity Levels Reflect Seasonal Patterns

Global airline capacity may have fallen by 1.4% week-on-week but there is no need to panic, this is consistent with the normal seasonal patterns that we see in early September and is certainly not a response to any pandemic activity. Quite simply we all must go back to work and for some leisure airlines that means a chance to ease the utilisation on their aircraft, and for others a chance to undertake planned maintenance on their fleets; aviation is after all a reflection of economic strength and activity around the globe.

Airline capacity remains at 85% of the pre-pandemic level and that has been a similar percentage for many months, and as we have said many times before, will not change until some major markets re-open for business and that may not be before early in 2023.

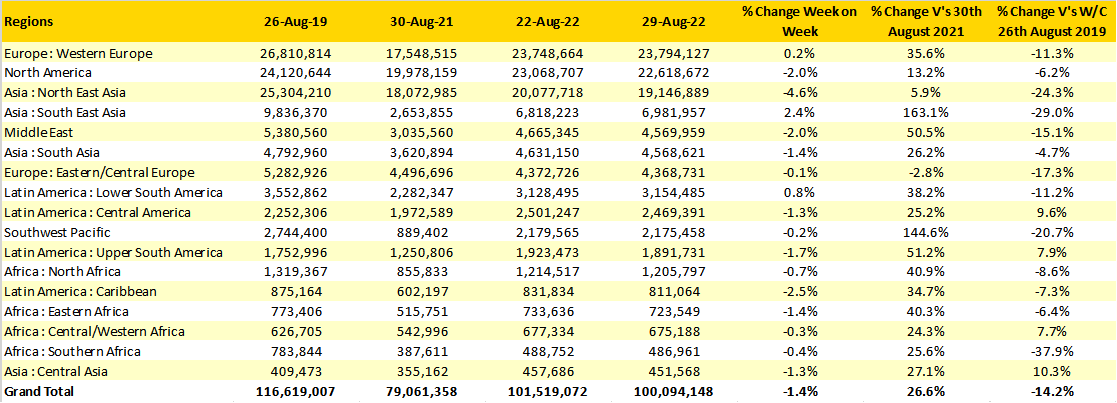

Table 1 – Scheduled Capacity by Region

Source: OAG

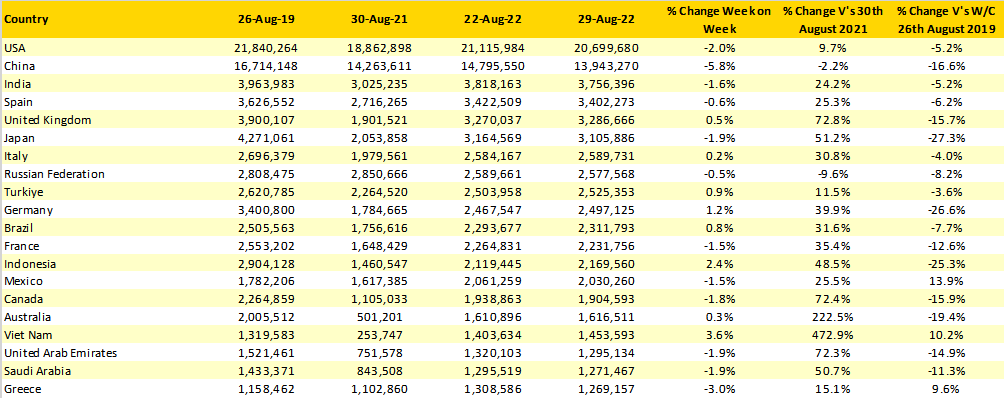

USA At 95% of 2019 Capacity Levels

Having not shown the table last week for the sake of those in the United States we can once again confirm that the country remains the largest aviation market in the world with some 20.7 million seats scheduled this week which represents nearly 95% of the 2019 weekly level. Six other country markets in the top twenty are at over 90% of their pre-2019 capacity levels, whilst Greece and Mexico are both significantly up on their 2019 capacity - both markets perhaps continuing to benefit from their “open for business” stance through the pandemic, if that continues through to next year will be interesting.

Table 2 – Top Twenty Country Markets

Source: OAG

Read original article