Another week of more than 102 million scheduled seats makes this the eighth consecutive week above the 100 million mark and with September still holding above that point global capacity appears to remain strong through to the end of the summer holiday season; what happens after that though is anyone’s guess!

There appears to be growing concern about the last quarter of the year as a combination of economic news and limited visibility around corporate demand is finally beginning to get the attention it deserves. Whilst airline CEOs have a fine line to tread in being confident in future performance and realistic, those that are can smell the coffee (or indeed JetA1) and are finally getting a bit more cautious about the winter season. They may have reason too, but let’s focus on what remains of the summer!

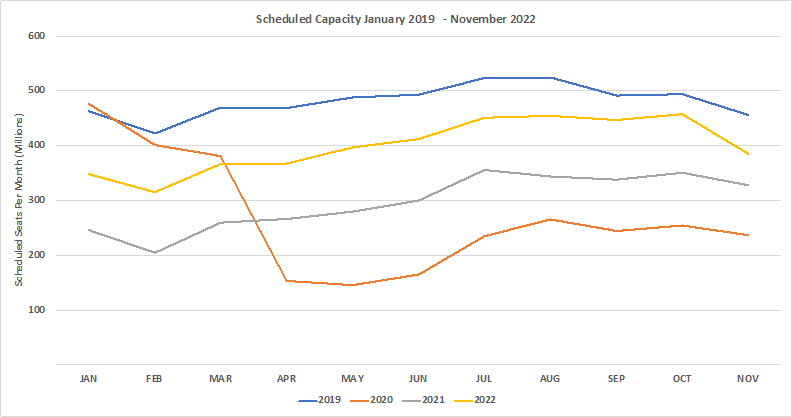

As we head to the end of August, we have now added November to the forward-looking monthly scheduled capacity. Since November is the first month of the winter season there is always a noticeable reduction in capacity as airlines take a chance to catch up on heavy maintenance checks for their aircraft, and operating crews get a decent night’s sleep for the first time in months. This year the current reduction in capacity between October and November is around 16%, in 2019 (our reference point for everything now) was half that amount at 8%. It may be that network planners have yet to add capacity back for the winter season, or it may be that there is more caution amongst the bean counters in required capacity for the winter season; sensible airlines are likely to be cautious of what November brings and this could be one of the first indications of that caution.

Chart 1 - Weekly Capacity Changes by Region, Forward Quarter

Source: OAG

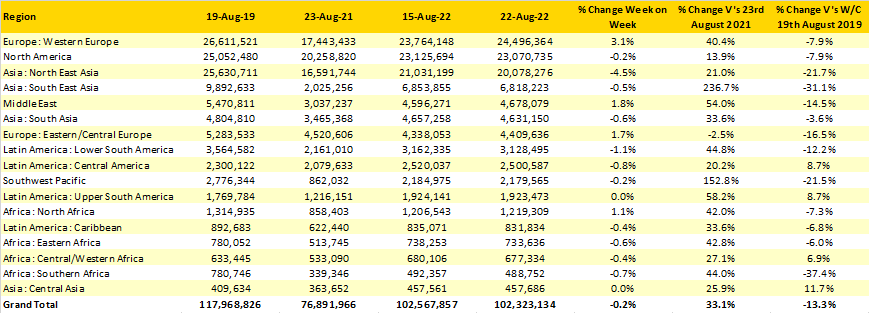

Region Focus: Western Europe Retains First Position With +3% Scheduled Airline Capacity

Western Europe has consolidated its position in first place with a 3% increase in airline capacity this week and at 24.5 million is now less than 8% below the 2019 level. The gap between the next two largest regions – North America and North East Asia - also widened this week as they both have reductions in airline capacity. North East Asia, well China, has seen an 888,588 seat reduction week-on-week. However, there are also positive developments coming out of China, in the last three weeks the number of scheduled international flights have increased by 6% with new routes such as Manchester – Beijing, Hangzhou – Lisbon and Bangkok (Don Muang) – Nanjing being operated with once weekly frequency. The next few weeks is traditionally busy as Chinese students travel to overseas locations to finish their studies, so expect to see a few more routes added in the coming weeks.

Table 1 – Scheduled Capacity by Region

Source: OAG

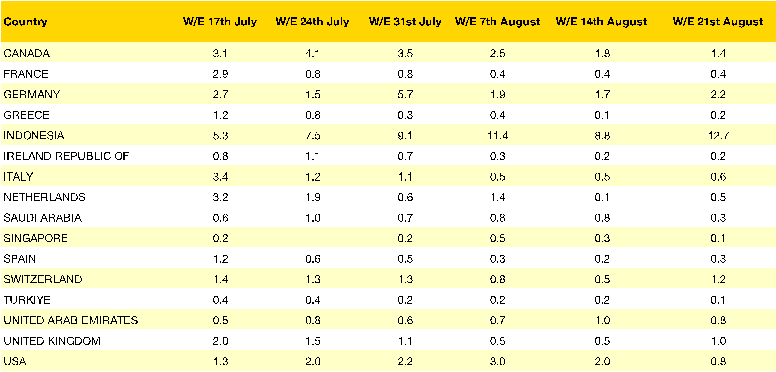

Flight Cancellation Rates Improve

Although we could tell you that the United States is still the largest country market and that the top twenty countries remain unchanged week-on-week, or that Italy has jumped ahead of Russian Federation - we won’t do that this week. Instead, we are going to share some of the latest data on flight cancellation rates by selected major countries over the past few weeks since things appear to be getting better, unless of course you are a Manchester United supporter!

In nearly every country the rate of flight cancellations appears to be coming down with many markets now at, or below, less than one percent of flights being cancelled last week. There are of course exceptions, Indonesia continues to have a very high cancellation rate (although in fairness it was never great) and both Switzerland and the United Kingdom saw higher rates of cancellations last week. And of course, these are country averages so there are some airports in most countries that continue to have challenges; London City Airport had a 3.9% cancellation rate and Houston Intercontinental “enjoyed” a 2.8% cancellation rate last week.

Table 2 – Selected Country Market Cancellation Rates (Percentages %)

Source: OAG